The director may loan the company 1000 to pay a supplier or cover working capital requirements. Overdrawn DLA at Year End.

![]()

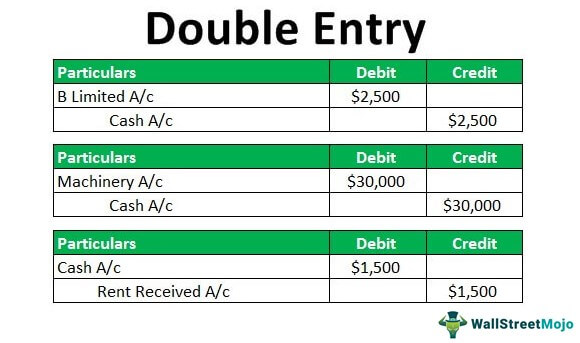

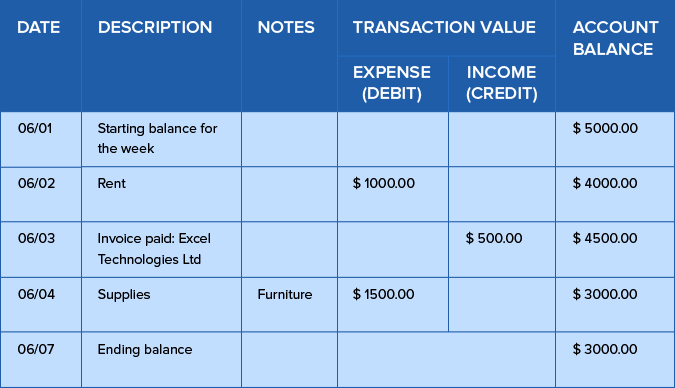

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

The DLA is a combination of cash in money owed to and cash out money owed from the director.

. This is the representation of the debtors that the company has at a given. For an example you borrowed 30000 from your company in June 2020. We need to present value the amount due to Directors since the Directors are financing the Company.

The Credit Card Due sub-ledger would include a record of the other half of the entry a credit for 5000. On 20 April the company has made a payment of 50000 to all directors. Under IFRS for SME - Para 1113 If the arrangement constitutes a financing transaction the entity.

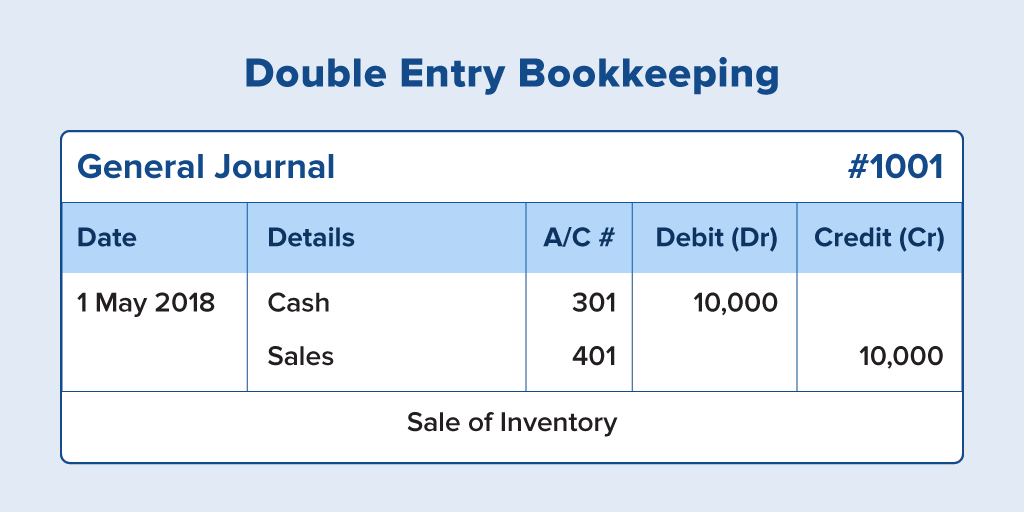

OK so the directors of a company have taken out a loan themselves that is used only for business purposes as they were unable to raise the money any other way. The general ledger would have two lines added to it showing both the debit and credit. S455 is charged at 325 of the outstanding loan or loans amount.

It is the amount of funds due to another party and is found in the general ledger. The repayments I am recording as obviously the one credit the sum of the two debits. Director has made paymentsettlement to Supplier using his own personal bank account.

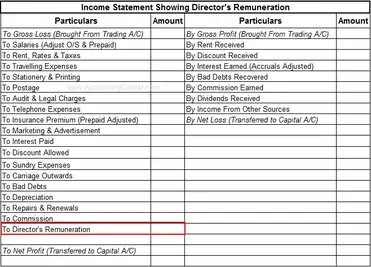

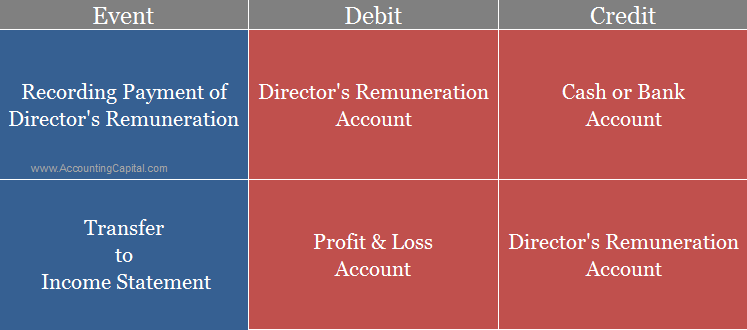

This is because the company has already serviced this order in terms of processing the relevant goods and services. The formatting makes it difficult to read but I think it shows break even reserves 87 at 300908. Please prepare the journal entries for the remuneration package.

Your company end-of-year is 31 st March 2021. To understand how double-entry bookkeeping works lets go over a simple example to solidify our understanding. If we run a payroll for you of say 125000 gross equating to 100000 net which you should pay yourself the 100000 salary due creates a credit in the Director Loan AccountDLA until such time that your company pays yourself the salary to show that the company still owes you as the director 1000.

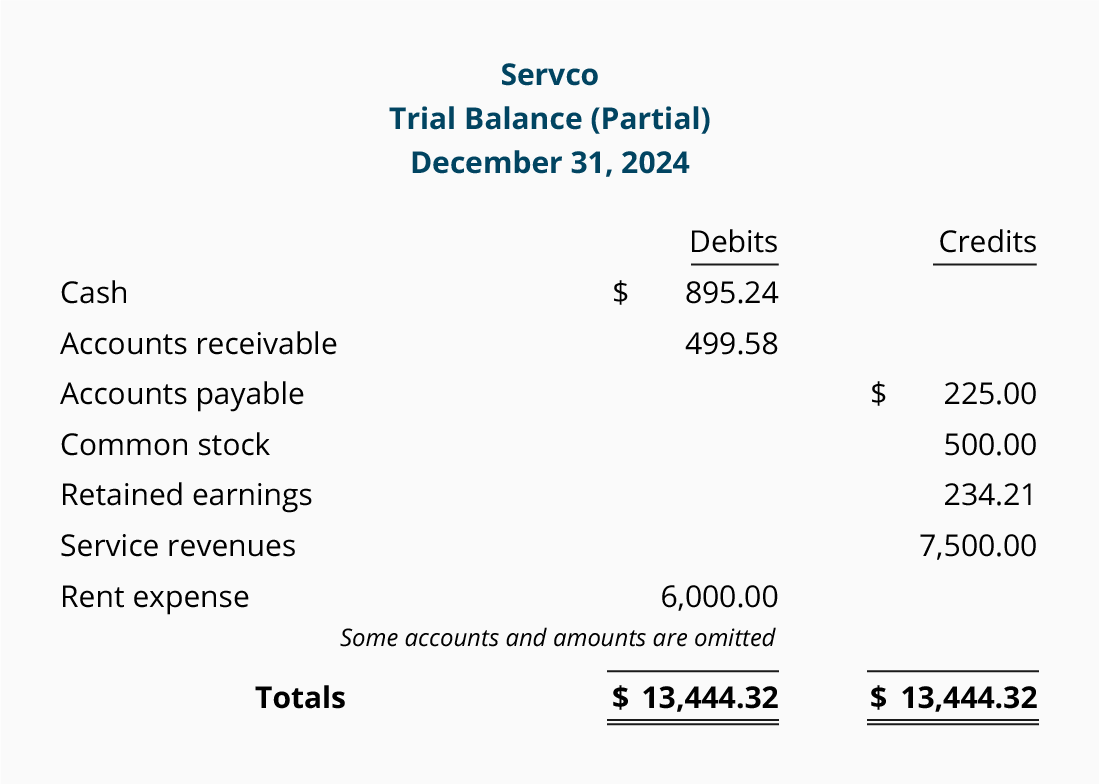

Amount due from director double entry. Hence we have present value the amount due to Director at zero value. The entry is a total of 6000 debited to several expense accounts and 6000.

Double Entry for Directors Loans. 45 be largely different 44 THOUGHTS ON DOUBLE ENTRY. If an individual makes a loan to a company and this is subsequently written-off the company will have a non-trading loan relationship credit equal to the amount written off.

Credit that is due from customers is considered to be a current asset. On 01 April the company has approved the remuneration package even the payment does not complete yet but we have to. Director loan write off double entry.

If the loan was made to an unquoted trading company the individual will crystalise a capital loss equal to the amount of the loan written. You pay a credit card statement in the amount of 6000 and all of the purchases are for expenses. Ill publish in my next writing.

Double Entry Bookkeeping Starting A Business And Its Initial Transactions Journal Entry For Loan Taken From A Bank Accountingcapital Related. As the double-entry system is followed in accounting. A director lent 100K into a firm but the firm is always in loss and can only reply 79K.

The draft accounts for the final period are showing a negative balance sheet. The calculation of interest is simple. He may also pay for several items of stationery and postage on behalf of the company using his own cash.

Accounting entry should be. Supplier Expenses Credit. Corporation Tax S455 25 of the balance of any overdrawn directors loan account still outstanding 9 months and 1 day after the end of the accounting period.

I have a small limited company client who have recently cased trading. DLA is an account on the company financial records that reports all transactions between the director and the company. That means that you have nine months after 31 st March to pay back the 30000 that is 31 st January 2021.

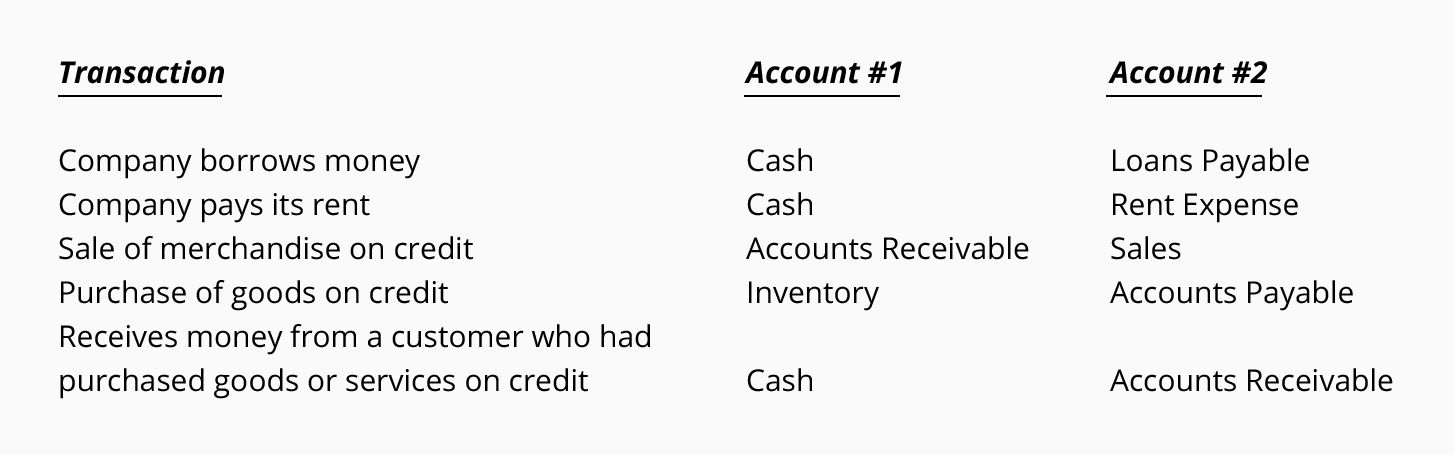

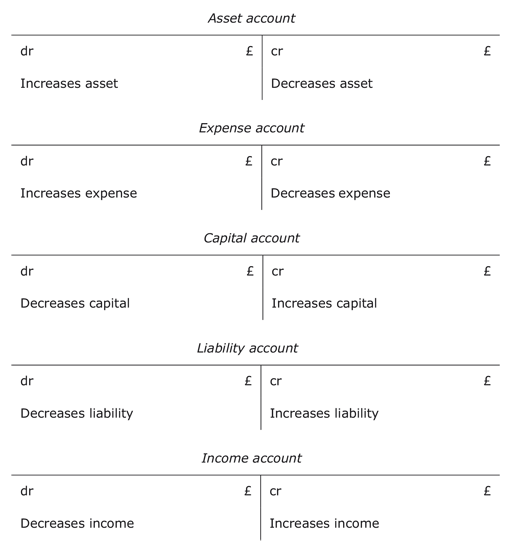

It is the basis for modern bookkeeping. The directors are owed a small amount of money by the company as a result of their loan accounts which have arisen mainly due to them paying company expenses personally and not reclaiming them. Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts.

The due to account will show a credit balance as it is a liability account. Cash in cash out. The director has been returned 79K already.

They put the money in the bank account. The double entries is as follows. Individual Loans written-off.

Amount due To Directors CR. Found inside Page 44The amount given as due on Current Account and Deposit Balances means that at a certain time on a certain day all the amounts found due by the Bank to its thousands of customers. Assume that Alpha Company buys 5000 worth of furniture for its office and pays immediately in cash.

In such a case one of Alphas asset accounts needs to be increased by 5000 most likely Furniture or Equipment while. Amounts due to the director from the company should be recorded in the companys books as a creditor while the amounts due from the director to the company should be recorded as a debtor. When an invoice for a purchase is received the due to account will be credited and an expense or asset account will be debited.

Amount due to Director But im not sure how to do it in QB. The interest will be taxable under Section 4 c of the Income Tax Act. The amount that is due from customers is also referred to as Accounts Receivable.

Overdrawn directors loan accounts is effectively an interest-free loan to the director and can have quite complex tax implications.

Double Entry Definition Examples Principles Of Double Entry

Double Entry Accounting Money Zine Com

Loan Repayment Principal And Interest Double Entry Bookkeeping

Bookkeeping Double Entry Debits And Credits Accountingcoach

Double Entry Accounting Type Of Accounting Zoho Books

Received Cash On Account Journal Entry Double Entry Bookkeeping

Journal Entry For Director S Remuneration Accountingcapital

Introduction To Bookkeeping And Accounting 3 6 The Accounting Equation And The Double Entry Rules For Income And Expenses Openlearn Open University

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-03-8b430eba78534c66be0eb416932fe80e.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

Double Entry Bookkeeping System Accounting For Managers

Difference Between Single Entry System And Double Entry System Zoho Books

General Journal In Accounting Double Entry Bookkeeping

The Accounting Equation And The Principles Of Double Entry Bookkeeping

Journal Entry For Director S Remuneration Accountingcapital

Gnucash And Double Entry Accounting Example Business Rocketscience Llc

Introduction To Bookkeeping And Accounting 3 6 The Accounting Equation And The Double Entry Rules For Income And Expenses Openlearn Open University

Bookkeeping Double Entry Debits And Credits Accountingcoach

Double Entry Bookkeeping System Accounting For Managers